About the Company

About the Company:

Established in 1993 and based in Hyderabad, the company specializes in designing, developing, and manufacturing advanced training simulators and equipment. Over the years, it has expanded its offerings to include anti-drone systems, earning strong endorsements from military, state police, and paramilitary forces. With a legacy spanning over three decades, the company has delivered more than 1,000 simulators to over 100 clients worldwide, solidifying its leadership in training solutions for defense and law enforcement agencies. Its success is driven by a strong emphasis on R&D and an asset-light manufacturing model, enabling scalable growth without a significant rise in net block, fixed costs, or debt. Additionally, a well-established vendor network in Hyderabad further strengthens its position in the industry.

Market Share:

Zen Technologies Ltd. is a leader in manufacturing defense training solutions with over 95% market share in tank simulators.

Promoters Insights:

Kishore Dutt Atluri, Co-founder and Joint Managing Director of Zen Technologies, holds a postgraduate degree in Computer Applications. Since co-founding the company in 1993, he has secured over 21 patents. Leading Zen's defense marketing initiatives, Atluri has played a key role in developing a comprehensive portfolio of Virtual and Live Simulation systems. These simulators serve Infantry, Armoured Corps, Mechanized Forces, and Air Defense, addressing the training needs of Police Forces, Central Police Organizations, civilians, and mining sectors.

Ashok Atluri, serving as the Chairman and Managing Director (CMD), played a pivotal role in designing simulators on the Windows-Intel platform. His significant contribution ensured product simplicity and adherence to industry standards.

Business Overview

An In-Depth Look at its Business Model

Zen Technologies operates within the defense and security sectors, specializing in the design, development, and manufacture of cutting-edge training simulators and anti-drone systems. The company caters to a diverse clientele, including armed forces, paramilitary organizations, security agencies, and police forces, both domestically and internationally. Zen Technologies has strategically positioned itself to capitalize on the growing demand for advanced defense technology, driven by increasing defense budgets, modernization efforts, and the push for import substitution.

Core Elements of the Business Model

Intellectual Property-Driven Approach: At the heart of Zen Technologies’ business model lies a strong emphasis on intellectual property (IP). The bill of materials for their products accounts for only 25-40% of the final product cost. This highlights the intrinsic value of their designs and technologies. This approach ensures that profitability margins are not significantly impacted by fluctuations in the cost of physical components. This IP-driven strategy is also reflected in their impressive portfolio of over 155 patents applied for, with approximately 75 granted, underscoring their position as a leader in technological innovation within the defense sector.

Asset-Light Operations: Zen Technologies employs an asset-light model, which enables them to scale operations efficiently. Rather than focusing on capital-intensive manufacturing, they outsource significant portions of their production. This approach allows the company to maintain high profitability while growing rapidly. Final assembly and integration are typically kept in-house, ensuring quality control and customization.

Focus on Research and Development (R&D): R&D is a cornerstone of Zen's business strategy. They have a dedicated R&D team that continually innovates and develops new technologies to meet the evolving needs of modern warfare. This commitment is demonstrated by their substantial investments in R&D, with over ₹85 Crores spent in the last five years, and ₹26.65 Crores in FY24 alone. This focus on R&D not only drives innovation but also creates high entry barriers for potential competitors. The company has commissioned an AI center in Hyderabad, showcasing their commitment to staying ahead of the technological curve.

Diverse Product Portfolio: Zen Technologies offers a broad range of products and solutions, including:

- Training solutions (Live Ranges, Live Simulation, Virtual Simulation, and Combat Training Centers).

- Counter-drone solutions.

- Operational equipment. This wide range of offerings enables the company to cater to the diverse needs of its customer base. Virtual simulation is a key offering that allows many people to be trained simultaneously without sacrificing the quality of learning.

Patent Portfolio: Zen Technologies has filed over 155 patents globally, with approximately 75 patents granted. This large portfolio demonstrates a dedication to technological advancement and innovation within the defense sector.

New Product Launches: Zen's commitment to innovation is reflected in new product launches, such as Hawkeye, Barbarik-URCWS, Prahasta, and Sthir Stab 640. These new products are developed in collaboration with their subsidiary, AI Turing Technologies.

R&D Driven Approach:

The company's commitment to research and development (R&D) is central to its business strategy. Over 30% of their workforce is dedicated to R&D

Customer-Centric Approach: The company's success is driven by a dedicated R&D team that consistently delivers top-tier products tailored to the needs of their customers. Zen Technologies places a high priority on customer satisfaction and has established robust mechanisms to receive and respond to customer complaints and feedback through multiple channels including customer service hotlines, emails, online portals, and in-person meetings.

Strategic Partnerships: Zen Technologies has formed partnerships with five trade and industry chambers/associations. These affiliations provide access to valuable knowledge and contribute to industry advancement.

Revenue Generation: The company derives revenue primarily through the sale of homeland security equipment and simulators (92%) and by providing training solutions and other services (8%)

Financial Report

Share Capital & Number of Employees

Share price and Volume (last 1 year):

Month and Year |

|---|

| Volume |

Prev Close

N/A

Sector

N/A

Market Cap

₹15010 Cr.

TTM PE

N/A

Sectoral PE Range

N/A

PE Remark

N/A

BSE

N/A

COMPANY TYPE | EVERGREEN |

|---|

| (IN INR CR) |

|---|

| (IN INR CR) |

|---|

Key Metrics

Market Cap

₹15,010 Cr.

Current Price

₹1,662

PE Ratio

74.1

D/E Ratio

0.04

ROCE%

46%

CWIP

₹14.3 Cr.

ROIC%

N/A

Cash Conversion Cycle

577 day

ROE%

33%

PEG Ratio

1.3

Business Segment

Key Highlights & Management Guidance

Industrial Outlook

The miscellaneous industry, encompassing a wide range of products and services across sectors, is expected to see stable growth due to its diverse nature and cross-sectoral dependencies. This category includes industries such as packaging, industrial services, niche manufacturing, and specialized equipment production. The demand drivers vary but are influenced by overall economic growth, industrialization, infrastructure development, and advancements in technology.

Key trends shaping the outlook include:

Automation and Digitalization: Increasing adoption of Industry 4.0 technologies, automation, and smart manufacturing processes is expected to boost productivity and efficiency in various miscellaneous industries.

Sustainability Initiatives: Rising environmental concerns are leading to innovations in sustainable materials, green manufacturing practices, and waste management solutions, pushing companies within this space to adopt eco-friendly processes.

Government Policies and Incentives: Supportive policies, like the Production Linked Incentive (PLI) schemes and tax benefits, are driving growth in specialized manufacturing and niche industries within the miscellaneous sector.

Global Supply Chain Shifts: The shift towards regionalized supply chains, driven by geopolitical factors and the COVID-19 pandemic, is creating new opportunities for smaller, specialized players to enter global markets.

Overall, the outlook for the miscellaneous industry remains positive, with steady demand growth driven by technological advancements, increased industrial activity, and evolving customer needs across sectors.

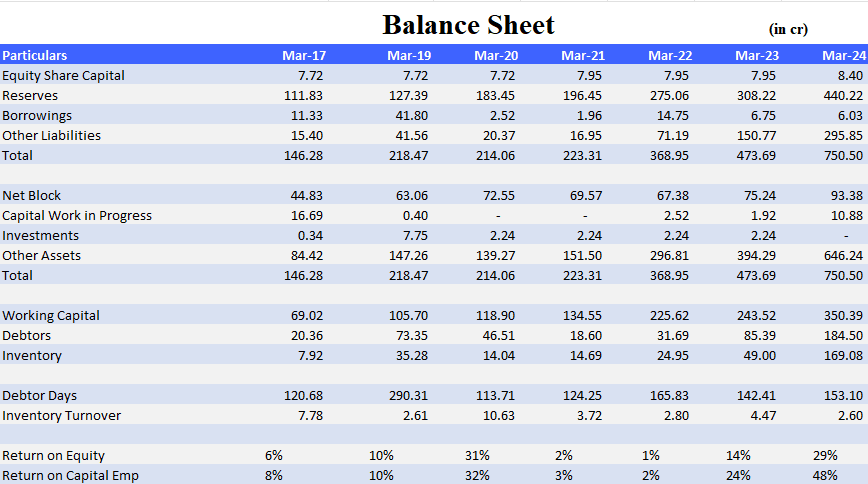

Financial Highlights

| PARTICULARS |

|---|

Shareholding Pattern

Sep'2024 | Dec'2024 | |

|---|---|---|

| Promoters | 51.26% | 49.05% |

| FIIs | 5.72% | 8.29% |

| DIIs | 8.05% | 8.97% |

| Retailers | 34.49% | 33.24% |

Capsule’s View

Value Creation and Competitive Advantage:

- High Entry Barriers: The substantial investments in R&D throughout the company's history create significant limitations for new market entrants. This creates a strong competitive advantage for Zen Technologies.

- Scalability and Efficiency: The combination of the asset-light model and IP-driven approach contributes to the company's scalability and operational efficiency. These factors contribute to the company's high profitability and robust EBITDA margins, which reached 43% in FY24.

- Global Footprint: Zen Technologies is expanding its presence in both domestic and international markets, further amplifying its global reach and technological leadership. The company has an export component of approximately 31% in its order book.

- Focus on Indigenous Technology: Zen Technologies' business model supports India's push for self-reliance in defense technology. By focusing on indigenous R&D and manufacturing, Zen contributes to the country's defense modernization efforts.

Industry Outlook:

Global Defense Industry Growth: The global defense industry is experiencing robust growth, driven by increased geopolitical tensions, technological advancements, and a renewed focus on military modernization. The global defense market reached approximately $2.1 trillion in FY24, with a year-on-year growth of 3.8%. Market forecasts project continued growth at a CAGR of 3.5-4% over the next five years, reaching a value of approximately $2.5 trillion by 2028-29. This growth is spurred by increasing defense budgets and the need for advanced military capabilities.

Indian Defense Sector Transformation: The Indian defense industry is undergoing a significant transformation, fueled by the government's push for self-reliance in defense manufacturing and the modernization of armed forces. This has created unprecedented opportunities for domestic players like Zen Technologies. The Indian government has significantly increased its defense budget, allocating ₹6.21 Lakh Crores ($74.9 Billion) in the Union Budget 2024-25, a 13% increase over the previous year. This includes ₹1.72 Lakh Crores ($20.7 Billion) for capital outlay, aimed at acquiring new weapons, platforms, and infrastructure development. The overall Indian defense market is estimated to reach $70 billion by 2030, with domestic defense production projected to exceed $25 billion by 2025.

Government Initiatives: Several government initiatives are creating a favorable ecosystem for companies like Zen Technologies:

'Make in India' and 'Atmanirbhar Bharat': These initiatives promote indigenous design, development, and manufacturing, aligning with Zen Technologies' long-held vision of indigenous IP creation.

Indigenously Designed, Developed, and Manufactured (IDDM) category: The introduction of the IDDM category has been a game-changer, aligning national policy with indigenous IP creation and benefiting companies like Zen Technologies.

Positive Indigenisation Lists: The government has notified four positive indigenization lists, comprising 411 items that will be procured only from domestic industry, providing a significant boost to indigenous manufacturing. * Agnipath Yojana: The Agnipath Yojana is contributing to the need for more training and simulation. * Defense Industrial Corridors: The development of two defense industrial corridors in Uttar Pradesh and Tamil Nadu is fostering an ecosystem of defense manufacturing and innovation.

Shift to Simulator-Based Training: The Indian armed forces are increasingly adopting simulator-based training to enhance operational readiness while reducing costs and environmental impact. This trend creates significant opportunities for companies specializing in advanced simulation technologies like Zen Technologies. The Chief of Army Staff has emphasized that the era of simulator-based training has just begun, underscoring the vast potential for simulation technologies. A study also suggests that adopting crew gunnery simulators could lead to potential financial savings and prevent significant carbon emissions.

Growing Demand for Counter-Drone Systems: The proliferation of drones has emerged as a significant security threat, necessitating the development of advanced anti-drone systems. This has led to increased investment and innovation in counter-drone technologies. The counter-drone market was valued at approximately USD 1.9 billion in 2023, with a growth forecast of reaching USD 15.3 billion by 2032 at a CAGR of 26%. Zen Technologies, with its early investment in anti-drone technology, is well-positioned to be a preferred supplier in this area.

Export Opportunities: India's defense exports have witnessed substantial growth, reaching an all-time high of ₹15,920 Crores ($1.95 Billion) in FY24, a 54% increase over the previous year. The government has set an ambitious target of achieving $5 Billion in defense exports by 2025. Zen Technologies has already made significant inroads into international markets, particularly in the Middle East, Africa, and CIS countries, and sees substantial export potential for its advanced solutions.

Technological Advancements: There is a growing importance of space and cyber domains, leading to greater investment in related technologies and capabilities. Additionally, the future of military simulation will involve mixed-reality training with the integration of VR, AR, and MR technologies. The use of AI and data analytics will enhance training effectiveness by providing personalized feedback