About the Company

KRN Heat Exchanger and Refrigeration Limited (KRN) specializes in manufacturing fin and tube-type heat exchangers for the HVAC&R industry. Utilizing non-ferrous metals such as copper and aluminum, the company produces various products, including condenser coils, evaporator units, evaporator coils, header/copper components, fluid and steam coils, and sheet metal parts.

KRN offers heat exchangers in diverse shapes and sizes, with tube diameters ranging from 5mm to 15.88mm, designed to meet specific client needs and adhere to industry standards. Over the years, KRN has strategically expanded its operations by enhancing its manufacturing capabilities and product offerings, as evidenced by its investment in state-of-the-art facilities and advanced testing methodologies, such as helium leak testing and salt spray testing, to ensure the highest quality standards.

Promoter Insights:

- Anju Devi is the promoter and whole-time director, having provided consultancy services at LLOYD Electric. She has been with KRN Heat Exchangers since its founding in 2017.

- Santosh Kumar Yadav is the promoter, CEO, chairman, and managing director with over 19 years of experience in manufacturing heat exchangers and refrigeration units. He previously headed operations at LLOYD Electric and has been with the company since its inception.

Business Overview

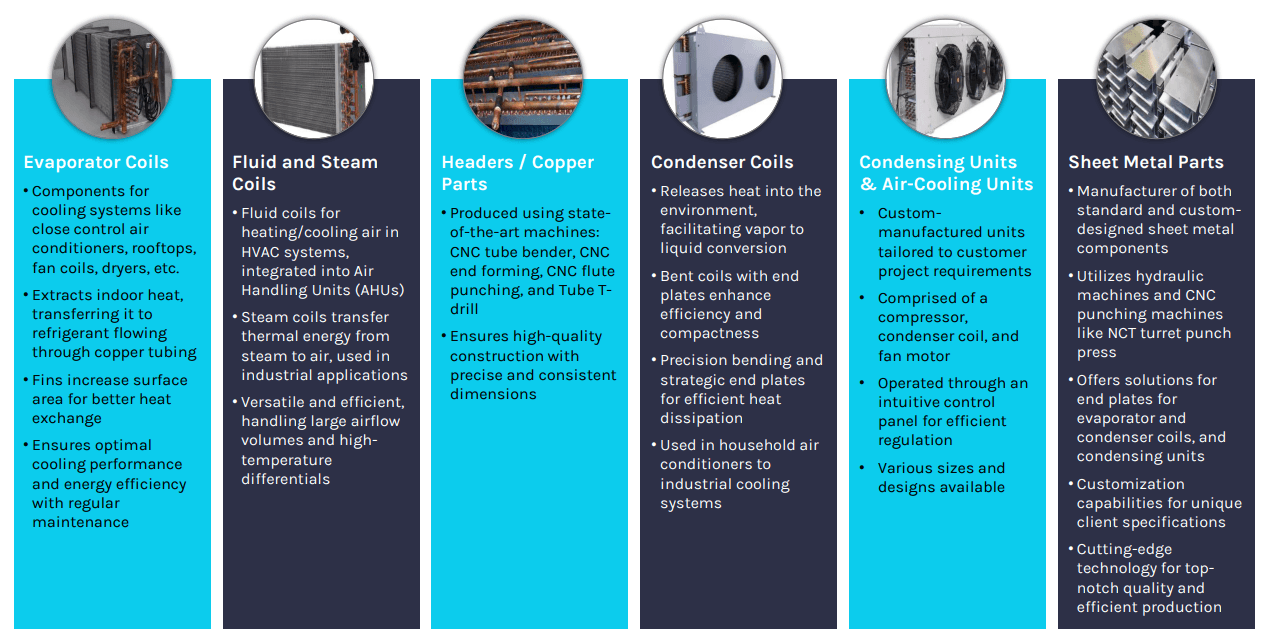

Products Portfolio:

1. Evaporator Coils

Evaporator coils are a key component in cooling systems such as air conditioners, rooftop units, fan coils, dryers & more. Their primary function is to absorb indoor heat and transfer it to the refrigerant flowing through copper tubing. The fins on these coils significantly increase the surface area, enhancing heat exchange between the refrigerant and air. As air passes over the evaporator coil, it gets cooled, and this cooled air is circulated back into the room, maintaining the desired indoor temperature. The refrigerant absorbs the heat, transforms into gas, and then moves to the compressor and condenser coil to release the absorbed heat. Regular maintenance of these coils ensures efficient cooling and energy efficiency.

2. Condenser Coils

Condenser coils are vital in HVAC and refrigeration systems for heat dissipation. Their role is to release heat from the system into the surrounding air, usually outdoors. As refrigerant in the system changes from vapor to liquid, the heat energy is released during the condensation process. The design of condenser coils, especially those with bent configurations and end plates, maximizes surface area and improves heat transfer. These coils help condensing units and chillers achieve efficient cooling with reduced energy consumption. Their compact and space-saving design makes them suitable for a variety of applications, from home air conditioners to industrial cooling systems.

3. Fluid and Steam Coils

Fluid coils are commonly used in HVAC systems to heat or cool air inside buildings. They are essential for maintaining comfortable temperatures in controlled environments, such as office buildings and industrial processes. These coils work by transferring heat between air or water, ensuring energy efficiency. Steam coils, on the other hand, are used in industrial applications like power generation plants and food processing. They transfer heat from steam to air, raising the air's temperature, or from chilled water to cool the air, making them essential for precise temperature control and energy efficiency in various industries.

4. Condensing and Air-cooling Units

The company specializes in custom manufacturing condensing and air-cooling units that meet the specific needs of its customers. A condensing unit consists of a compressor, condenser coil, and fan motor, all connected through pipelines and housed within a durable casing. These units are controlled through a panel to ensure precise operation. The company’s ability to custom-manufacture these units in various sizes and designs gives them a competitive edge. These units are integral to refrigeration systems, ensuring effective cooling for a wide range of applications.

5. Headers / Copper Parts

Headers are important components in HVAC systems that distribute the refrigerant evenly across the system’s tubes. The company uses advanced machines such as CNC tube benders and CNC flute punching machines to produce headers with precision. CNC technology ensures that these parts are produced with exact dimensions and minimal imperfections, contributing to the overall efficiency and performance of HVAC systems.

6. Sheet Metal Parts

As a manufacturer of sheet metal components, the company produces parts like end plates for evaporator and condenser coils, as well as other custom-designed sheet metal parts used in HVAC systems. They use advanced machinery, including hydraulic machines and CNC punching machines, to produce precise and customized metal parts. This ability to manufacture both standard and custom parts allows the company to meet the specific needs of its clients. The precision of CNC punching machines ensures high-quality production and enables the company to serve a broader market with tailored solutions.

Raw material supply chain

Company operates as a fully integrated manufacturing unit, transforming raw materials into finished heat exchangers. By maintaining strong supplier relationships, it ensures a consistent supply of raw materials, helping to control costs, quality, and supply stability, which provides a competitive edge. The company sources most of its raw materials through imports, mainly from Malaysia, South Korea, Thailand, Vietnam, and China, accounting for over 79% of total purchases.

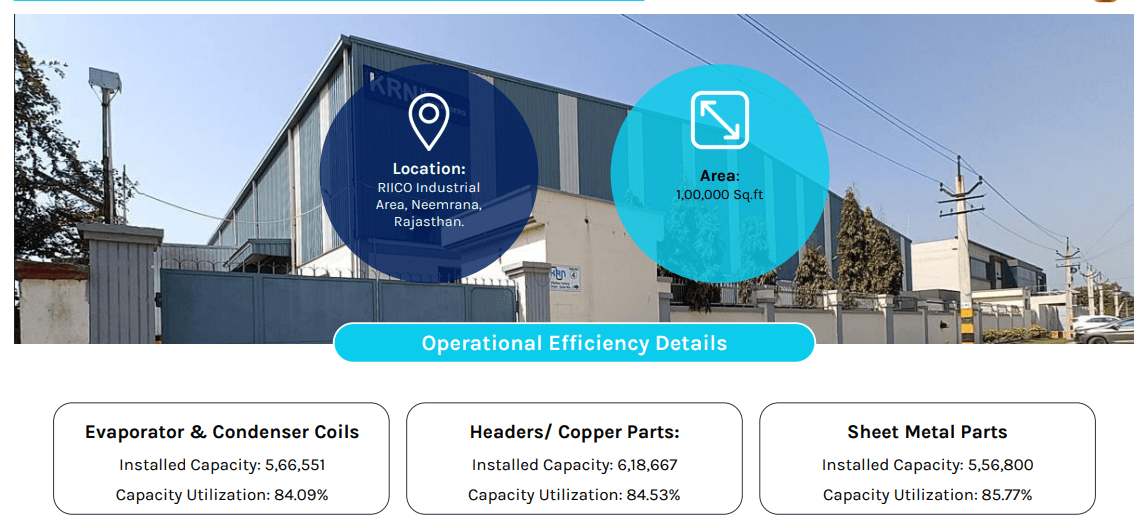

Manufacturing Facilities:

Company operates two manufacturing units in Neemrana, Rajasthan, with a total installed capacity of 566,551 units for evaporator and condenser coils, 618,667 units for headers/copper parts, and 556,800 units for sheet metal parts. In FY24, the company achieved over 84% capacity utilization.

Manufactuirng Process:

Company manufacturing process of heat exchangers involves several meticulous steps to ensure efficiency and reliability. It begins with Component Fabrication, where tubes, shells, and fins are produced using extrusion, rolling, and stamping techniques. These components are then assembled into the final configuration with precise alignment and fit. Welding and Brazing techniques are employed to create robust, leak-proof connections. In the Testing and Quality Assurance phase, hydrostatic or pneumatic pressure tests verify structural integrity, while helium leak detection ensures the absence of leaks, and performance testing confirms thermal efficiency. During Finishing and Shipping Preparation, surface treatments are applied to enhance durability, followed by a thorough final inspection to meet all quality standards before packaging. Finally, in the Transportation and On-Site Inspections stage, the heat exchangers are securely shipped and inspected post-installation to confirm proper functionality.

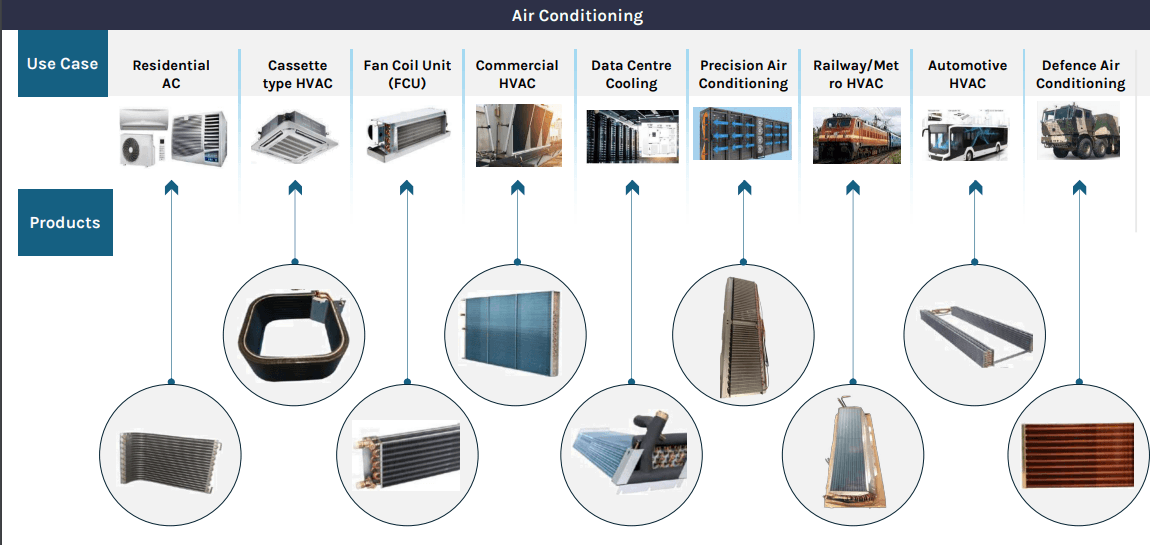

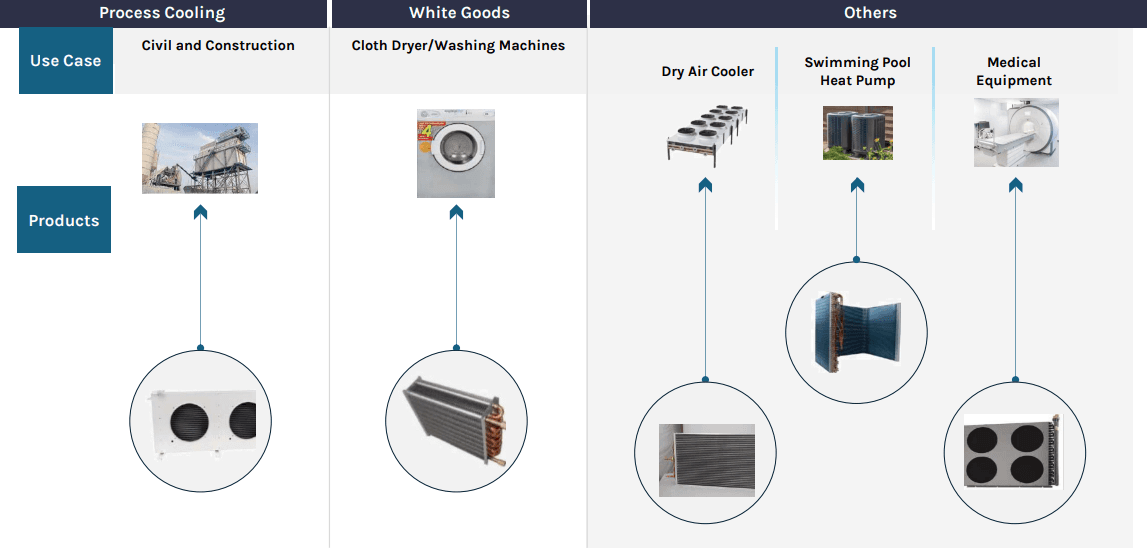

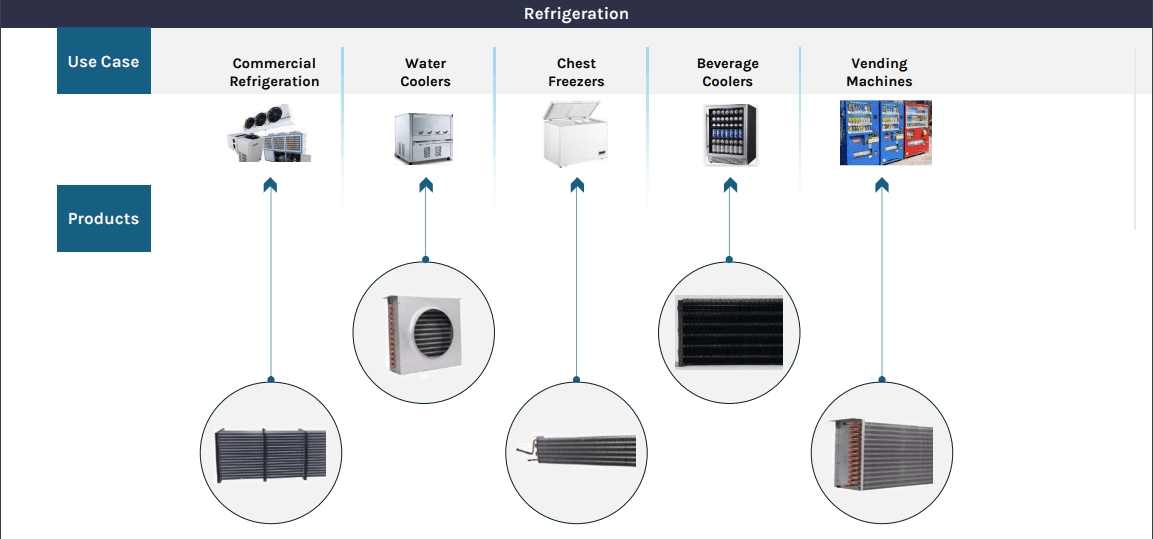

Product & Usage Scenarios:

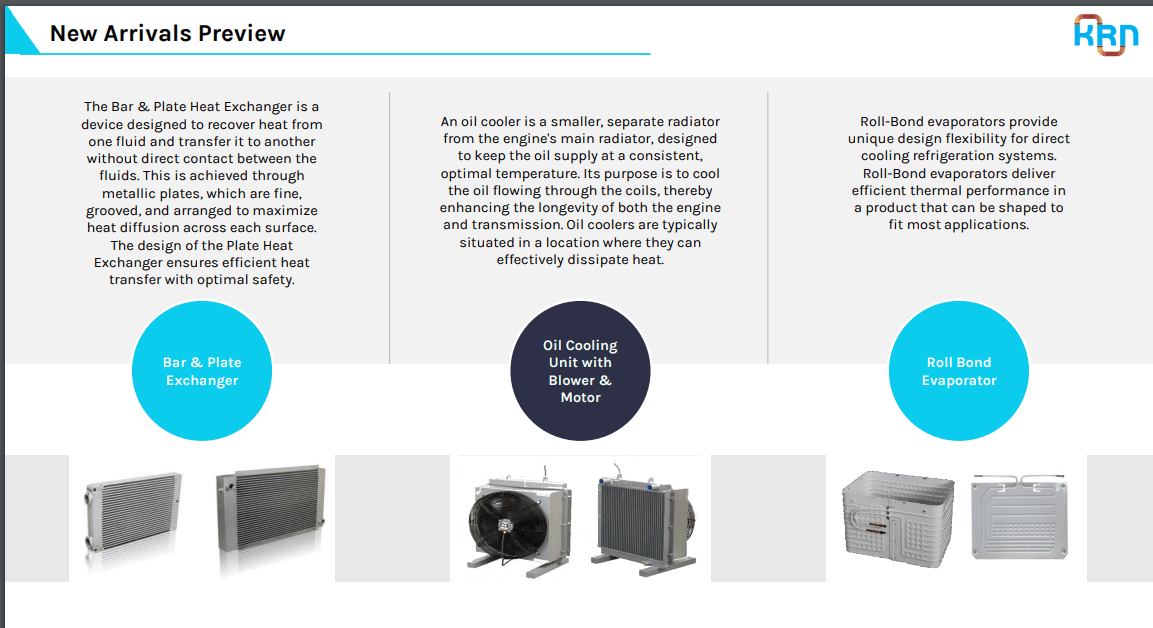

New Arrivals:

Company offers innovative solutions, including the Bar & Plate Heat Exchanger, which efficiently transfers heat between fluids without direct contact using fine, grooved metallic plates for optimal thermal diffusion and safety. The company also provides Oil Cooling Units with blowers and motors, designed to regulate oil temperature, enhancing engine and transmission performance through effective heat dissipation. Additionally, its Roll-Bond Evaporators deliver versatile design flexibility for direct cooling refrigeration systems, ensuring efficient thermal performance tailored to diverse applications.

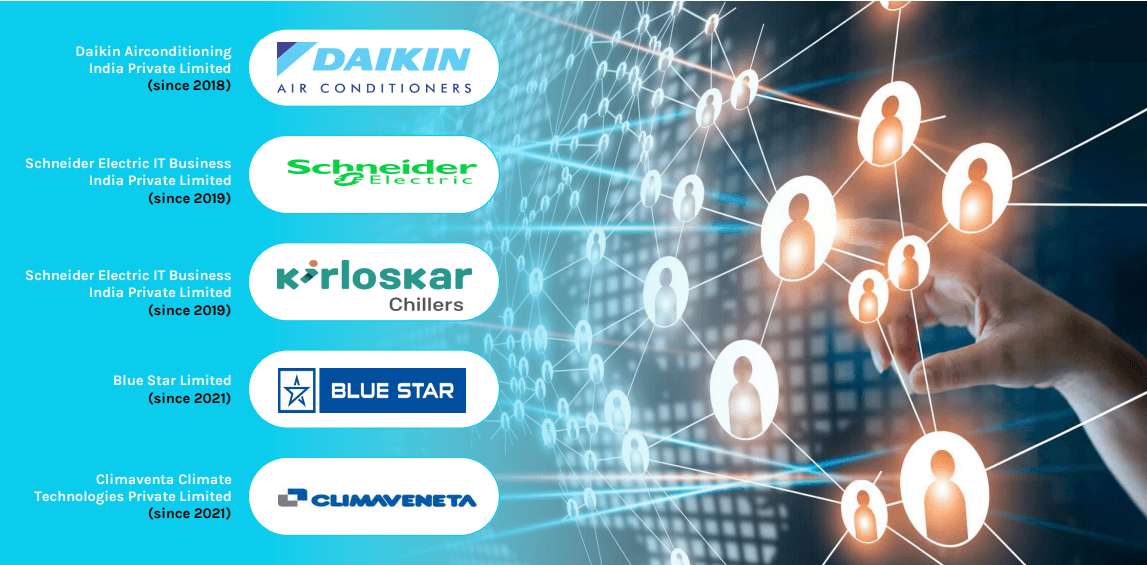

Clientele:

These products serve essential roles in air conditioning, heating, ventilation, refrigeration, and process cooling. KRN ensures product longevity and corrosion resistance with advanced nano and powder coatings. Known for quality and innovation, KRN partners with leading industry players like Daikin, Schneider Electric, and Blue Star, while strategically expanding its global reach and enhancing operational efficiency.

Geographical Wise Revenue Breakup FY24:

Domestic Sales

- Rajasthan: 41.24%

- Maharashtra: 11.04%

- Karnataka: 9.44%

- Haryana: 8.53%

- Uttarakhand: 3.81%

- Himachal Pradesh: 3.54%

- Gujarat: 2.50%

- Uttar Pradesh: 1.52%

- Diu Daman & Dadra Nagar: 1.32%

- Others: 2%

Exports:

- United Arab Emirates: 8.39%

- USA: 3.45%

- Italy: 2.34%

Revenue Bifurcation - Product wise

- Condenser Coils: 55.24%

- Evaporator Coils: 37.49%

- Other Operating Revenue: 5.70%

- Headers/ Copper Parts: 1.52%

- Sheet Metal Parts: 0.05%

Financial Report

Share Capital & Number of Employees

Share price and Volume (last 1 year):

Month and Year |

|---|

| Volume |

Prev Close

N/A

Sector

N/A

Market Cap

N/A

TTM PE

N/A

Sectoral PE Range

N/A

PE Remark

N/A

BSE

N/A

COMPANY TYPE | EVERGREEN |

|---|

| (IN INR CR) |

|---|

| (IN INR CR) |

|---|

Key Metrics

Market Cap

N/A

Current Price

N/A

PE Ratio

N/A

D/E Ratio

N/A

ROCE%

N/A

CWIP

N/A

ROIC%

N/A

Cash Conversion Cycle

N/A

ROE%

N/A

PEG Ratio

N/A

Business Segment

Evaporator Coils

Key components in cooling systems like air conditioners and fan coils, responsible for absorbing indoor heat and transferring it to the refrigerant in copper tubes.

Condenser Coils

Essential in HVAC&R systems, they release heat to the outside, enabling refrigerant to condense from vapor to liquid, expelling heat in the process.

Headers/Copper Parts

Distribute heat and flow evenly across parallel tubes, produced with advanced CNC machinery for high precision and quality.

Sheet Metal Parts

Used in heat exchanger components like shells and tubes, precisely customized using hydraulic and CNC punching machines.

Key Highlights & Management Guidance

Capacity Expansion and Investments:

- The company's ambitious plan is to expand its production capacity by six times through a new facility under construction. This facility is expected to begin operations in April 2025, with initial sampling starting in Q1 FY26 and full-scale commercial production by Q2 FY26. The total project cost is over ₹300 crore, and the company plans to fund it through IPO proceeds, internal accruals, and bank financing if needed. The expanded capacity will allow KRN to address its current capacity constraints, which have limited its ability to cater to growing customer demand, particularly from international markets.

Strategic Partnerships:

- The company has signed a ₹1,000 crore Memorandum of Understanding (MOU) with the Rajasthan government as part of its “Rising Rajasthan” initiative. This collaboration underscores KRN’s commitment to long-term strategic growth in the HVAC&R industry.

Product Innovation and Portfolio Diversification:

- KRN is diversifying its offerings by introducing new products such as bar and plate heat exchangers and roll bond evaporators. These additions cater to growing industries like electric locomotives, heavy machinery, and data centers. The company is leveraging its expertise in custom-designed heat exchangers to capture niche markets. For instance, the bar and plate heat exchanger is targeted at Indian Railways for use in electric locomotives and in the heavy equipment and compressor industries. Roll bond evaporators are also expected to have applications in specialized cooling solutions.

Data Center Space:

- The company's data center business currently includes two to three key customers. Last year, revenue from this segment accounted for approximately 7% of total revenue. Schneider Electric is a primary client, along with two additional customers in the data center space. The company supplies to these three major OEMs and is actively exploring export opportunities to expand its customer base in the data center sector.

Industrial Outlook

Engineering sector is highly promising, driven by rapid technological advancements, infrastructure development, and increased investment in automation and innovation. Key trends include the growing demand for smart manufacturing, renewable energy infrastructure, and sustainable solutions in industries such as construction, automotive, aerospace, and energy. The integration of AI, IoT, robotics, and Industry 4.0 technologies is transforming production processes, enhancing efficiency, and reducing costs. Governments worldwide are emphasizing infrastructure modernization and green energy projects, creating additional growth opportunities. However, challenges like supply chain disruptions, skilled labor shortages, and fluctuating raw material prices remain concerns for the sector. Overall, the engineering industry is expected to experience steady growth, supported by rising demand for precision engineering and sustainable development initiatives.

Financial Highlights

| PARTICULARS | H1FY24 | H1FY25 |

|---|---|---|

| Sales | ₹1,606.42 Cr | ₹1,868.80 Cr |

| EBITDA | ₹315.52 Cr | ₹384.42 Cr |

| Net Profit | ₹194.83 Cr | ₹242.81 Cr |

Shareholding Pattern

Sep'2024 | Oct'2024 | Sep'2024 | |

|---|---|---|---|

| Promoters | 70.79% | 70.79% | - |

| FIIs | - | 4.05% | 4.05% |

| DIIs | - | 7.36% | 7.46% |

| Retailers | - | 17.80% | 17.69% |

Capsule’s View

Industry Outlook:

The global heat exchanger market reached a value of USD 16.8 billion in 2023, growing steadily at a compound annual growth rate (CAGR) of 6.4% from 2019 to 2023. A heat exchanger is a device used to transfer heat between two or more fluids, and it plays a critical role in industries such as chemical manufacturing, oil & gas, power generation, metallurgy, and HVAC (Heating, Ventilation, Air Conditioning, and Refrigeration). The demand for heat exchangers globally is primarily driven by rising industrialization, energy-efficient technologies, and the growing need for better thermal management solutions across industries.

In India, the heat exchanger market reached USD 689 million in 2023, reflecting strong growth with a CAGR of 10% from 2019 to 2023. This higher growth rate is due to rapid industrialization and urbanization, coupled with a strong focus on infrastructure development. India’s government has invested heavily in infrastructure projects, which has increased the demand for HVAC systems, where heat exchangers are essential components. Chemical manufacturing and the oil & gas industry are the top consumers of heat exchangers in India, while the power and energy sector, HVAC, and metallurgy also contribute significantly. These five industries accounted for 80% of the heat exchanger market's revenue in 2023.

Key Segments:

Shell & Tube Heat Exchangers: This is the largest segment in the Indian market. These heat exchangers are highly versatile and used in industries like oil & gas, power generation, and chemical processing. They consist of a series of tubes, one set containing the fluid that needs to be heated or cooled, and the other set containing the fluid responsible for the heat transfer.

Finned Tube Heat Exchangers: Another major product segment, finned tube heat exchangers, generated USD 146 million in revenue in 2023 and grew at a CAGR of 10.7% between 2020 and 2023. Finned tube heat exchangers are compact in design and used for energy-efficient cooling applications. Their compact nature makes them a popular choice because they require less space and are cost-effective compared to other types of heat exchangers. The segment is expected to reach USD 326 million by 2029, driven by the rising need for efficient cooling systems across various industries.

HVAC Systems and Data Centers: In HVAC systems, heat exchangers are vital for heating, cooling, heat recovery, dehumidification, and moisture control. The Indian HVAC market alone generated an annual turnover of USD 9.1 billion in 2023. This growth is supported by the government’s substantial investment in infrastructure, with USD 1.45 trillion earmarked for the next five years. Additionally, data centers, which are critical to the information technology industry, heavily rely on heat exchangers in their HVAC systems to maintain optimal operating temperatures. Without these systems, data centers would struggle to keep their servers cool, which is essential for smooth operations.

Driving Factors:

- Industrial Growth: Rapid urbanization, industrialization, and infrastructure development are increasing the demand for heat exchangers, particularly in energy-intensive sectors like oil & gas, chemical manufacturing, and power generation.

- Government Investment: The Indian government’s investment in infrastructure is driving demand for HVAC systems and, consequently, heat exchangers. These investments are set to boost the heat exchanger market significantly in the coming years.

- Energy Efficiency: As companies focus more on reducing energy consumption, the demand for heat exchangers that can provide energy-efficient cooling and heating solutions is growing, especially in industries like data centers and manufacturing.

Challenges:

- Supply Chain Dependency: The heat exchanger industry in India is dependent on raw material imports. Any disruption in this supply chain, due to import restrictions or rising tariffs, could negatively impact production and increase costs.

- Technological Advancements: The industry also needs to keep pace with the latest advancements in heat exchanger technology to remain competitive, especially as industries move towards more sustainable and energy-efficient solutions.

In conclusion, the heat exchanger market, both globally and in India, is on a growth trajectory due to rising demand in key industries, the need for energy efficiency, and increasing government investments in infrastructure. Finned tube heat exchangers are expected to see the highest growth, thanks to their compact size and efficiency. The Indian market, in particular, stands to benefit from these trends, although supply chain challenges and the need for technological adaptation remain important considerations for sustained growth.

Future Outlook:

Export Growth Strategy:

With a focus on markets like North America and Europe, KRN plans to capitalize on the anti-dumping tariffs against Chinese products and the growing preference for reliable, customized solutions. Key customers like Schneider Electric have provided avenues for both domestic and international growth.

Diversified Applications:

The company is targeting high-growth sectors, including data centers, electric locomotives, transportation, and HVAC solutions for commercial buildings. This diversification reduces dependency on specific segments like room air conditioning.

Customer Base Expansion:

KRN is actively onboarding new clients and catering to existing ones. The company has over 200 customers in its pipeline, with a strategy to expand its portfolio to include advanced heat exchangers like bar-and-plate and roll-bond designs.